Texas Insurance License Exam Study Guide PDF: A Comprehensive Plan

Navigating the Texas insurance licensing process demands a robust study plan, leveraging comprehensive PDF guides and resources․ Kaplan and XCEL offer tailored prep,

while Mometrix provides secrets to success․

Detailed breakdowns of Life & Health and Property & Casualty topics, alongside practice exams, are crucial for mastering exam content․ Quizlet flashcards aid memorization․

Ensure your manual aligns with the Test Content Outline (TCO), covering all essential material․ These resources will help you confidently approach the state exam․

Understanding the Texas Department of Insurance (TDI)

The Texas Department of Insurance (TDI) is the regulatory body overseeing the insurance industry within the state, playing a pivotal role in the licensing process․ Understanding its structure and functions is paramount for aspiring insurance professionals․ TDI enforces state insurance laws, protects consumers, and ensures the financial stability of insurance companies operating in Texas;

Candidates can directly contact TDI with questions regarding license maintenance post-issuance․ The department’s website provides a wealth of information, including licensing requirements, exam details, and continuing education guidelines․ Familiarizing yourself with TDI’s resources is a crucial first step in preparing for the exam and a successful career in the Texas insurance market․

TDI’s regulatory oversight extends to all lines of insurance, including life, health, property, and casualty․ Staying informed about TDI’s updates and rulings is essential for maintaining compliance and providing accurate information to clients throughout your professional journey․

Exam Eligibility Requirements

Before embarking on your Texas insurance license exam preparation, confirming your eligibility is crucial․ Generally, applicants must be at least 18 years old and possess a legal right to work in the United States․ A pre-licensing education course, aligned with TDI’s requirements, is typically mandatory before sitting for the exam․

These courses cover essential insurance concepts and Texas-specific regulations, ensuring candidates have a foundational understanding of the industry․ Proof of course completion must be submitted to the testing provider before scheduling your exam․ Background checks are also standard procedure, verifying applicants’ integrity and suitability for a position of public trust․

Specific requirements may vary depending on the license type (Life & Health vs․ Property & Casualty)․ Reviewing the TDI website for the most up-to-date and detailed eligibility criteria is highly recommended․ Meeting these prerequisites ensures a smooth and successful application process․

Types of Texas Insurance Licenses

Texas offers a variety of insurance licenses, catering to different specializations within the industry․ The two primary categories are Life and Health, and Property and Casualty․ A Life and Health Insurance License allows individuals to sell life, health, accident, and disability insurance products, focusing on personal risk management and financial security․

Conversely, a Property and Casualty Insurance License enables agents to market insurance covering property risks (like homeowners and auto) and liability risks (like general liability and workers’ compensation)․ Some agents opt for a combined license, permitting them to sell both life/health and property/casualty products․

Additional specialized licenses exist for areas like Personal Lines (focused on individual insurance needs) and Commercial Lines (catering to businesses)․ Choosing the right license depends on your career goals and desired area of expertise․ Thoroughly researching each option is vital before beginning your study plan․

Life and Health Insurance License

Securing a Life and Health Insurance License in Texas requires focused preparation on specific regulations and product knowledge․ The exam covers topics like life insurance policy provisions, health insurance benefits, and the intricacies of Medicare and Medicaid․ Understanding Texas Life Insurance Regulations is paramount, including policy types, underwriting procedures, and claim settlement practices․

Similarly, mastery of Texas Health Insurance Regulations is essential, encompassing group and individual health plans, managed care organizations, and the Affordable Care Act’s impact․ Comprehensive study guides, like those offered by Kaplan and Mometrix, are invaluable resources․

Practice exams focusing on these areas will solidify your understanding․ Flashcards, such as those available on Quizlet, can aid in memorizing key terms and concepts․ A solid grasp of these regulations is crucial for passing the exam and serving clients effectively․

Property and Casualty Insurance License

Obtaining a Property and Casualty Insurance License in Texas demands a thorough understanding of coverages, policy provisions, and state-specific regulations․ The exam focuses on areas like homeowners insurance, auto policies, commercial property, and general liability․ Texas Property Insurance Regulations are critical, including coverage for perils like windstorm, hail, and fire, as well as appraisal and subrogation processes․

Equally important is knowledge of Texas Casualty Insurance Regulations, encompassing bodily injury and property damage liability, uninsured/underinsured motorist coverage, and personal injury protection․ Utilizing a comprehensive study guide, such as those from XCEL or Kaplan, is highly recommended․

Practice exams specifically designed for the P&C exam will reinforce your learning․ Resources like Mometrix’s prep materials offer valuable insights and test-taking strategies․ A strong foundation in these areas is essential for exam success and professional competence․

Essential Study Materials

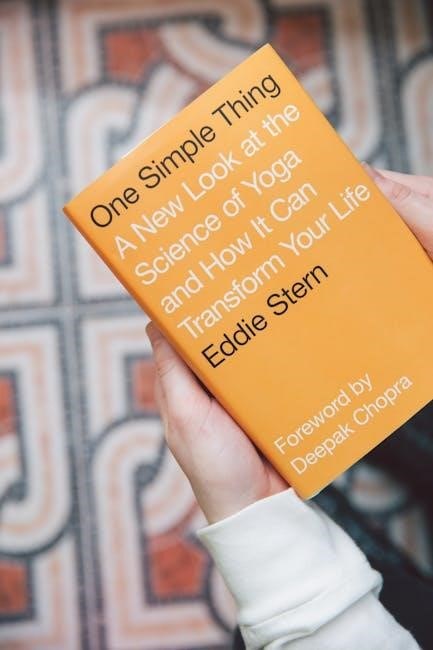

Preparing for the Texas Insurance License Exam necessitates a curated collection of study materials․ A quality insurance study manual, aligned with the Test Content Outline (TCO), is paramount․ PDF study guides from providers like Kaplan and XCEL offer structured learning paths, covering key concepts and regulations․

Supplement these with practice exams – a crucial component for gauging your readiness and identifying areas needing improvement․ Mometrix Test Preparation provides a dedicated prep guide with proven strategies․ Flashcards, such as those available on Quizlet, are excellent for memorizing definitions and key terms․

Don’t overlook official TDI resources and exam notes․ Combining these materials will create a well-rounded study experience, maximizing your chances of success on exam day․ Remember to prioritize materials specifically tailored to the Texas licensing requirements․

Recommended Study Guides & Prep Courses

Several reputable study guides and prep courses can significantly enhance your exam preparation․ Kaplan Financial Education offers comprehensive packages tailored to various learning styles and budgets, providing a structured approach to mastering the material․ XCEL provides additional study tools and review classes, aiming for first-time exam success․

Mometrix Test Preparation’s “Secrets Study Guide” is a popular choice, focusing on proven strategies and content mastery․ Consider utilizing online resources like Quizlet for interactive flashcard study sessions, reinforcing key definitions and concepts․ Exam IQ also provides focused preparation․

Look for materials specifically designed for the Texas exam, ensuring alignment with state-specific regulations and content․ Evaluate course formats – online, in-person, or self-paced – to find what best suits your learning preferences and schedule․

Key Exam Content Areas: Life and Health

The Texas Life and Health Insurance Exam heavily emphasizes state-specific regulations and policy provisions․ A strong understanding of Texas Life Insurance Regulations is paramount, including policy types, riders, and the application process․ Familiarize yourself with the requirements for life insurance agents and the nuances of different policy features․

Equally important is mastering Texas Health Insurance Regulations, covering health policy provisions, HIPAA compliance, and the intricacies of managed care plans․ Expect questions on individual and group health insurance, as well as long-term care coverage․

Focus on key concepts like policy ownership, beneficiary designations, and the responsibilities of insurance agents․ Thoroughly review the material covered in your chosen study guide, utilizing practice exams to identify areas needing further attention․

Texas Life Insurance Regulations

A significant portion of the Texas Life Insurance Exam centers on state-specific regulations governing life insurance policies․ Candidates must demonstrate knowledge of policy provisions, including grace periods, reinstatement rules, and policy loan provisions, as defined by the Texas Department of Insurance (TDI)․

Understanding the requirements for life insurance agents is crucial, encompassing licensing procedures, continuing education, and ethical conduct․ Be prepared to answer questions about insurable interest, policy applications, and the duties owed to policyholders․

Familiarize yourself with different life insurance policy types, such as term life, whole life, and universal life, and their respective features․ Study the regulations surrounding riders and endorsements, and how they impact policy benefits․ Thorough preparation with a comprehensive study guide is essential for success․

Texas Health Insurance Regulations

The Texas Health Insurance Exam heavily emphasizes regulations specific to health insurance products offered within the state․ Candidates need a firm grasp of the Texas Health Insurance Marketplace, including eligibility requirements for subsidies and the essential health benefits mandated by the Affordable Care Act (ACA)․

Key areas of focus include regulations surrounding HMOs, PPOs, and POS plans, as well as individual and group health insurance policies․ Understand the rules regarding pre-existing conditions, waiting periods, and network adequacy standards․

Be prepared to address questions concerning HIPAA compliance, patient privacy, and the handling of health information․ A quality study guide will cover topics like COBRA, Medicare, and Medicaid as they apply within Texas․ Mastering these regulations is vital for passing the exam and serving clients effectively․

Key Exam Content Areas: Property and Casualty

The Texas Property and Casualty Insurance Exam demands a thorough understanding of various coverage types and related regulations․ A comprehensive study guide will break down key areas like homeowners insurance, auto insurance, and commercial general liability policies․

Expect questions on property insurance perils, coverage limits, deductibles, and endorsements․ Auto insurance topics include liability coverage, collision, comprehensive, and uninsured/underinsured motorist protection․ Familiarize yourself with Texas-specific regulations regarding these policies․

Understanding concepts like subrogation, negligence, and the legal principles governing insurance contracts is crucial․ Practice exams and detailed explanations, as offered by Mometrix and Kaplan, are invaluable for mastering this complex material․ Focus on the specifics of Texas law and industry practices․

Texas Property Insurance Regulations

Texas property insurance regulations are distinct and require focused study for the licensing exam․ Understanding the Texas Department of Insurance (TDI) rules regarding policy forms, rates, and underwriting guidelines is essential․ Key areas include the Texas Basic Form and the Texas Standard Form policies․

Regulations cover mandatory coverages, such as windstorm and hail in designated coastal areas, and the requirements for disclosing potential hazards to policyholders․ Familiarize yourself with the rules surrounding appraisal clauses, subrogation rights, and cancellation/non-renewal procedures․

Study guides from Kaplan and Mometrix will detail these regulations, providing insights into how they impact policy language and claims handling․ Mastering these specifics will significantly improve your chances of success on the exam, ensuring you understand the legal framework governing property insurance in Texas․

Texas Casualty Insurance Regulations

Texas casualty insurance regulations encompass a broad range of coverages, demanding thorough preparation for the licensing exam․ Auto insurance, general liability, and workers’ compensation are key areas requiring detailed knowledge of TDI rules and statutes․

Understanding concepts like bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage is crucial․ Regulations dictate requirements for policy language, rate filings, and claims settlement practices․ Pay close attention to no-fault insurance provisions and the handling of auto accident claims․

Study materials, including those from XCEL and Quizlet flashcards, will help you navigate these complexities․ Focus on understanding subrogation rights, appraisal processes, and the legal implications of different coverage types․ A solid grasp of these regulations is vital for passing the exam and providing competent advice to clients․

Understanding the Exam Format

The Texas insurance license exam format is primarily multiple-choice, designed to assess your comprehension of state laws, regulations, and insurance principles․ Preparation resources, like those offered by Kaplan and Mometrix, emphasize familiarizing yourself with this question style․

Expect a timed exam, requiring efficient time management skills․ The number of questions varies depending on the license type – Life & Health or Property & Casualty․ Thorough study guides, including PDF versions, will provide practice questions mirroring the actual exam’s difficulty and content․

Familiarize yourself with the exam interface and navigation․ Understanding how to flag questions and review answers is essential․ Resources from XCEL and exam prep courses will offer simulated testing environments to build confidence and refine your test-taking strategy․

Question Types and Strategies

The Texas insurance exam predominantly features direct, application-based multiple-choice questions․ Study guides, particularly those in PDF format, should include numerous practice questions to hone your skills․ Resources like those from Kaplan and Mometrix focus on simulating the exam’s question style․

Strategies include carefully reading each question, identifying keywords, and eliminating obviously incorrect answers․ Pay close attention to wording – questions often test your understanding of legal definitions and policy provisions․ Utilize flashcards (Quizlet) to reinforce key terms․

Time management is crucial; don’t dwell too long on any single question․ If unsure, flag it and return later․ Comprehensive prep courses from XCEL will provide strategies for tackling challenging questions and maximizing your score․

Passing Score and Recertification

A passing score on the Texas insurance license exam generally requires a 70% or higher, though the exact number can vary․ Thorough preparation using comprehensive study guides – available in PDF format – is essential to achieve this benchmark․ Resources like Kaplan and Mometrix aim to equip candidates for success․

Once licensed, maintaining your credentials requires ongoing continuing education (CE)․ The Texas Department of Insurance mandates a specific number of CE hours per renewal period․ Detailed information regarding CE requirements can be found on the TDI website․

Recertification involves completing the required CE courses and paying a renewal fee․ Utilizing study materials focused on current regulations ensures you stay compliant and prepared for any updates․ XCEL offers review classes to aid in CE preparation․

Frequently Asked Questions (FAQs) About the Exam

Many candidates inquire about the best study materials; comprehensive PDF study guides from providers like Kaplan, Mometrix, and XCEL are highly recommended․ These resources align with the Texas Department of Insurance (TDI) exam content․

Another frequent question concerns exam difficulty․ While challenging, diligent preparation using practice exams and detailed content review significantly increases your chances of success․ Utilizing flashcards, like those available on Quizlet, can also be beneficial․

Candidates often ask about retake policies․ If you fail, you can retake the exam, but there may be waiting periods and associated fees․ Thoroughly review your weak areas using your study guide before retaking it․ The TDI website provides specific details․

Resources for Additional Study

Beyond core study guides, several resources bolster exam preparation․ The Texas Department of Insurance (TDI) website offers valuable information, including exam content outlines and licensing requirements․ Explore their resources for a deeper understanding of regulations․

Online platforms like YouTube host helpful videos․ Search for “Texas Insurance Exam” to find comprehensive study guides and explanations of key concepts; Channels like Insurance Exam Queen provide valuable insights․

Consider utilizing practice exams from various providers․ These assessments simulate the real exam environment and identify areas needing improvement․ Mometrix and Kaplan offer extensive practice question banks․ Don’t underestimate the power of flashcards, available on Quizlet, for memorizing crucial terms․

Practice Exams and Assessments

Simulating the exam environment is crucial; practice exams are indispensable․ Providers like Kaplan Financial Education and XCEL offer comprehensive practice tests designed to mirror the actual Texas insurance license exam format and difficulty․

Utilize these assessments to identify knowledge gaps and refine your study strategy․ Analyze your performance, focusing on areas where you consistently struggle․ Mometrix Test Preparation also provides a robust question bank for focused practice․

Beyond formal practice exams, create self-assessments using flashcards and study guides․ Quizlet offers pre-made flashcard sets covering key insurance concepts․ Regularly testing yourself reinforces learning and builds confidence․ Remember, consistent practice is the key to exam success, solidifying your understanding of Texas insurance regulations․

Exam Day Checklist

Thorough preparation extends beyond studying; a detailed checklist ensures a smooth exam day․ Confirm your testing location and time the day before, planning your route to avoid delays․ Bring a valid, government-issued photo ID – this is non-negotiable․

Review your study guide one last time, focusing on key concepts, but avoid cramming․ Ensure you’ve packed any permitted materials, though generally, only identification is allowed․ Arrive at the testing center early to allow time for check-in procedures․

Prioritize a good night’s sleep and a healthy breakfast to optimize focus and performance․ Maintain a calm and positive mindset․ Remember the practice exams you’ve completed and trust your preparation․ A well-executed checklist minimizes stress and maximizes your chances of success on the Texas insurance license exam․

Post-Exam Procedures: License Application

Successfully passing the Texas insurance license exam is a significant step, but it’s not the final one․ Following the exam, you’ll need to formally apply for your license through the Texas Department of Insurance (TDI) website․ This application requires detailed personal information and potentially a background check․

Ensure all information provided is accurate and consistent with your exam registration․ Pay the required licensing fees – these are subject to change, so verify the current amount on the TDI website․ Be prepared to submit supporting documentation if requested․

The TDI will review your application and, upon approval, issue your license․ Monitor your application status online․ Contact the TDI directly with any questions regarding the application process or licensing requirements․ Maintaining clear communication ensures a timely and successful license issuance․

Maintaining Your Texas Insurance License

Securing your Texas insurance license is just the beginning; ongoing maintenance is crucial for continued practice․ The Texas Department of Insurance (TDI) mandates continuing education (CE) courses for license renewal․ These courses ensure licensees stay current with industry regulations and best practices․

CE requirements vary depending on your license type and renewal cycle․ Regularly check the TDI website for specific course requirements and approved providers․ Completing CE courses within the designated timeframe is essential to avoid license lapse․

Licensees are responsible for tracking their CE credits and submitting proof of completion to the TDI․ The TDI may also conduct periodic license audits․ Staying informed and compliant with CE requirements guarantees your ability to legally conduct insurance business in Texas․

Contacting the Texas Department of Insurance

For direct assistance with licensing questions, exam-related inquiries, or post-licensing requirements, the Texas Department of Insurance (TDI) provides multiple contact avenues․ Candidates can reach the TDI through their official website, which hosts a comprehensive FAQ section addressing common concerns․

The TDI also offers a dedicated consumer helpline for general inquiries․ While not specifically focused on licensing, it can provide valuable guidance․ For specific licensing issues, utilizing the online contact form or locating the appropriate division’s contact information is recommended․

Remember to have your license number or application details readily available when contacting the TDI․ Prompt and accurate communication ensures efficient resolution of any issues․ The TDI’s commitment to accessibility supports licensees throughout their careers․